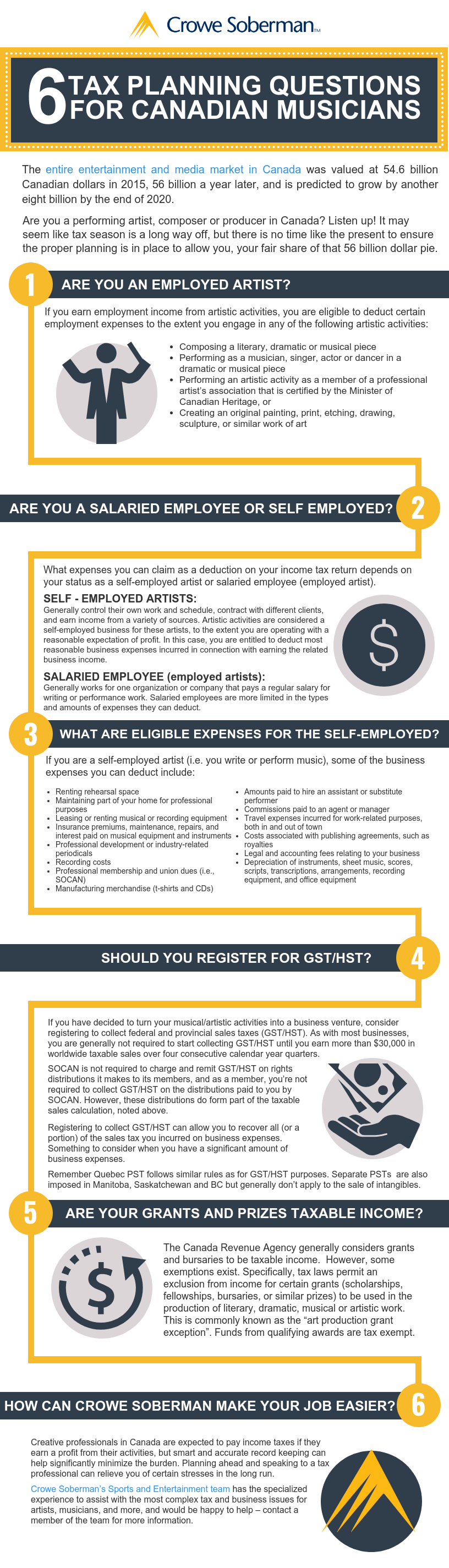

This infographic was prepared for the general information of our clients. Specific professional advice should be obtained prior to the implementation of any suggestion contained within. Please note that this publication should not be considered a substitute for personalized tax advice related to your particular situation.